I’m Stocking Up On Ammo & Why You Might Want To Also... Sam's Opinion

Please note first that the following is my ‘opinion’ on the recent times and those ahead, focused to the commercial/consumer ammo market in specific, and is not meant to be absolute in certainty, or follow an exact timeline. My comments on tariffs meant to be cause/effect related and not a political criticism or compliment, nor do I intend to pressure anyone to make a purchase they do not feel good about. This is simply my point of view from observations, coming form a man with 24+ years in the ammo business, noting the cycles as the come and went, and what I see as true recently and likely true in the future. This information is meant to be addressed to people that have unmet needs for ammo, a pending desire to purchase ammo and money to spare, and offer the best advice I can. I follow the same advice I give in such opinions I put in the newsletter, based on logic and observation and how that drives the industry, and have been stockpiling what I can afford and fit into storage comfortably. One thing I know is that it can take much longer than estimated to see the ’cause’ to lead to the ‘effect’ in the commercial ammo market, so how long it takes for a prediction to be proved true or false can be months, even several years in some cases, things can happen quickly or slowly, and when things change slowly other factors can come into play.

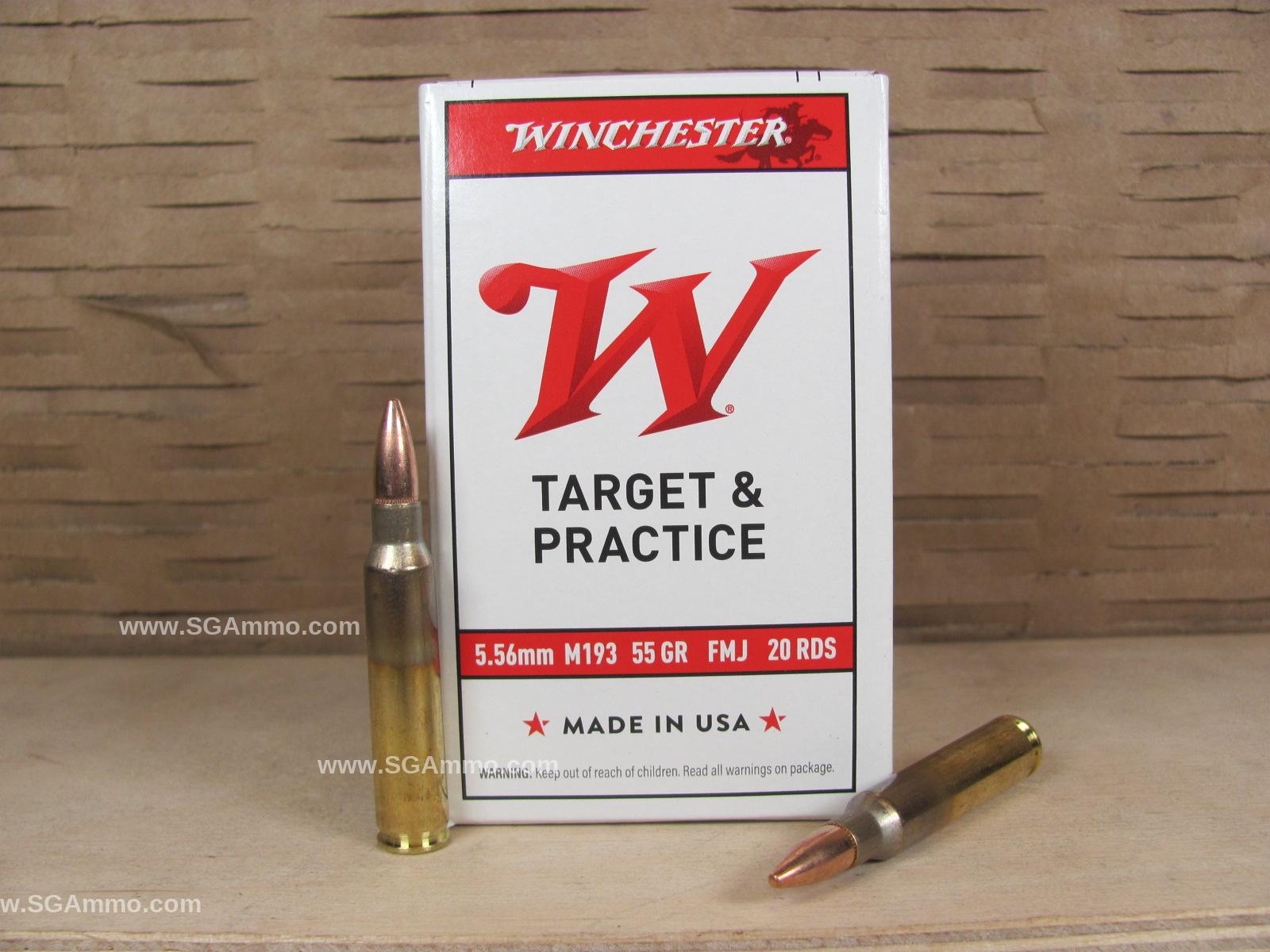

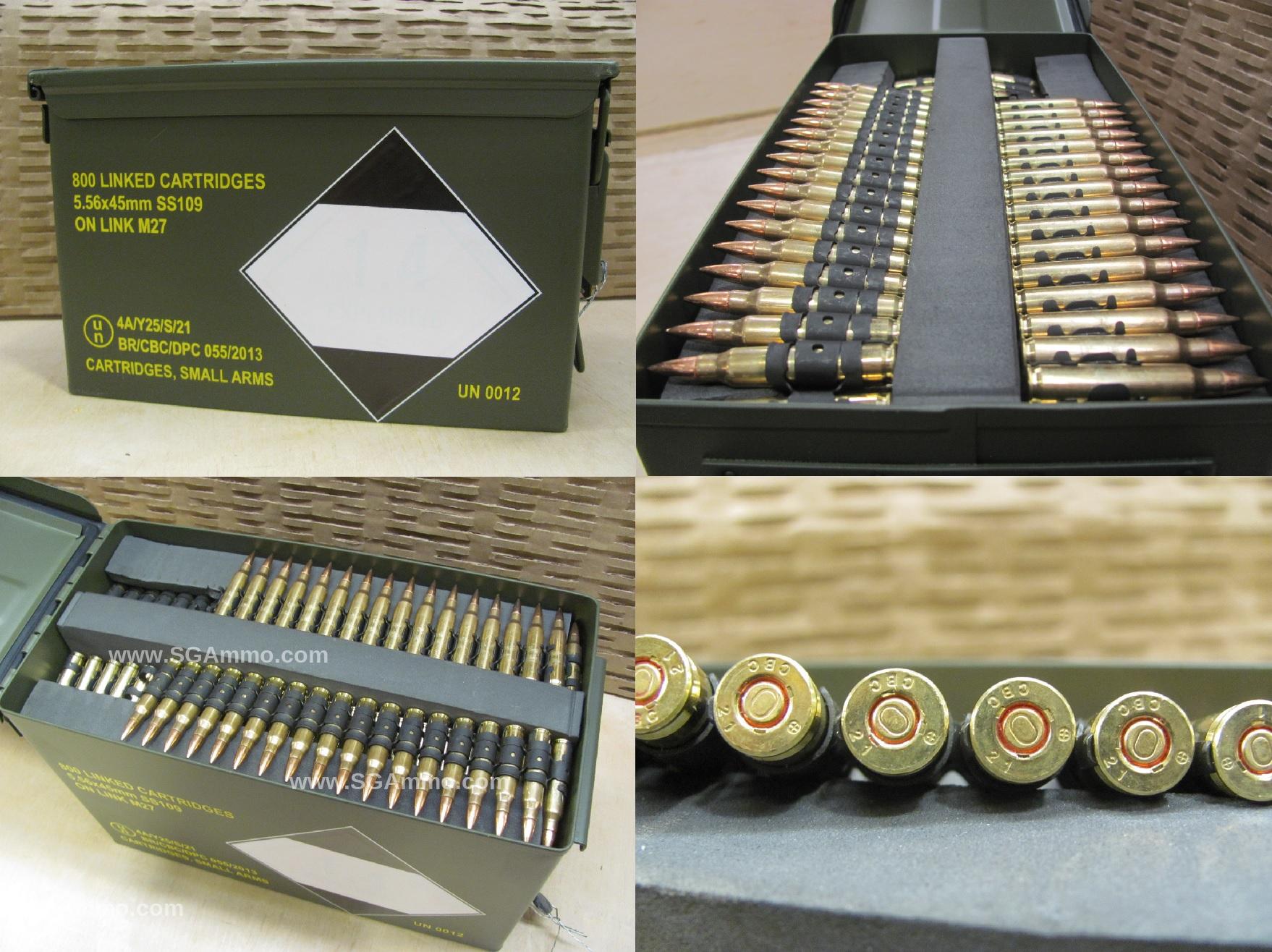

I believe deeply that it would be wise for consumers with spare cash to spend in their budget and unfilled needs for ammo to stock up on a few of your favorite calibers of ammunition by the case, or even just a few extra boxes of this and that while the summer slow season still holds strong gravity on market pricing. I am aware of several of the most significant manufacturers of ammo talking about price increases in October, and if they do, then others will follow their lead, but time will tell if they can force that onto the market given recent demand. Deals will still get made, but overall I see the desire and necessity of the factories to broadly increase prices on many low margin products. This was a summer of the lowest consumer demand for ammo since the big bust of 2017–2019. Low consumer demand forced manufacturing to hold at very low prices, and do layoffs of factory workers and management personnel that will be hard to replace when demand goes up someday and they are needed again, creating a supply chain issue that may present itself at some point if demand increases to more normal middle of the range levels. We saw many factories make special deals and sacrifices this summer, as well as other things to try to keep the product flowing and their businesses running, while absorbing big upward changes on input costs of materials like copper and imported raw materials and components. On the retail level, at my store we have not done any layoffs, but as people left for other reasons, they were not replaced. Should a hard rush hit with increased demand caused by various theoretical events, it will be much harder for both the factories and retailers like us to scale and staff up quickly to fill those needs. The past few weeks we have seen a brief spike in demand and a small but substantial rebound in the demand level, holding 20% to 35% above where it was this past 4 months after the surge. I also see copper prices and tariffs begin to show their effect on the supply chain and costs to replace dwindling inventories of stockpiled supplies. It will be hard not to pass on those costs due to the nature of this industry where profit margins were already deeply depressed the past few years, even if the demand is not there. From my point of view, I see the factories engaged in a “game of chicken,” where they hold down prices until the other major players give in, then from there they start to follow the leader. As the end of the month approaches, we were offered very few deals to make quarterly numbers even though I am sure the factories are all short on expectations, and I assume they are ‘giving up’ and excepting that sales/profit numbers will not be met. Personally, I have bet on the value in having inventory that may see an increase in value as prices rise and that difference can be either leveraged as a more competitive price or addition margin, most likely some of both. I have been have been stockpiling what I can afford and store or warehouse comfortably when the deal is right and the products are top quality and great values. My recommendation to my clients who don’t need the money for something else and know they need some ammo is that they do the same thing.

Thank you, Sam Gabbert, SGAmmo Owner